Table Of Content

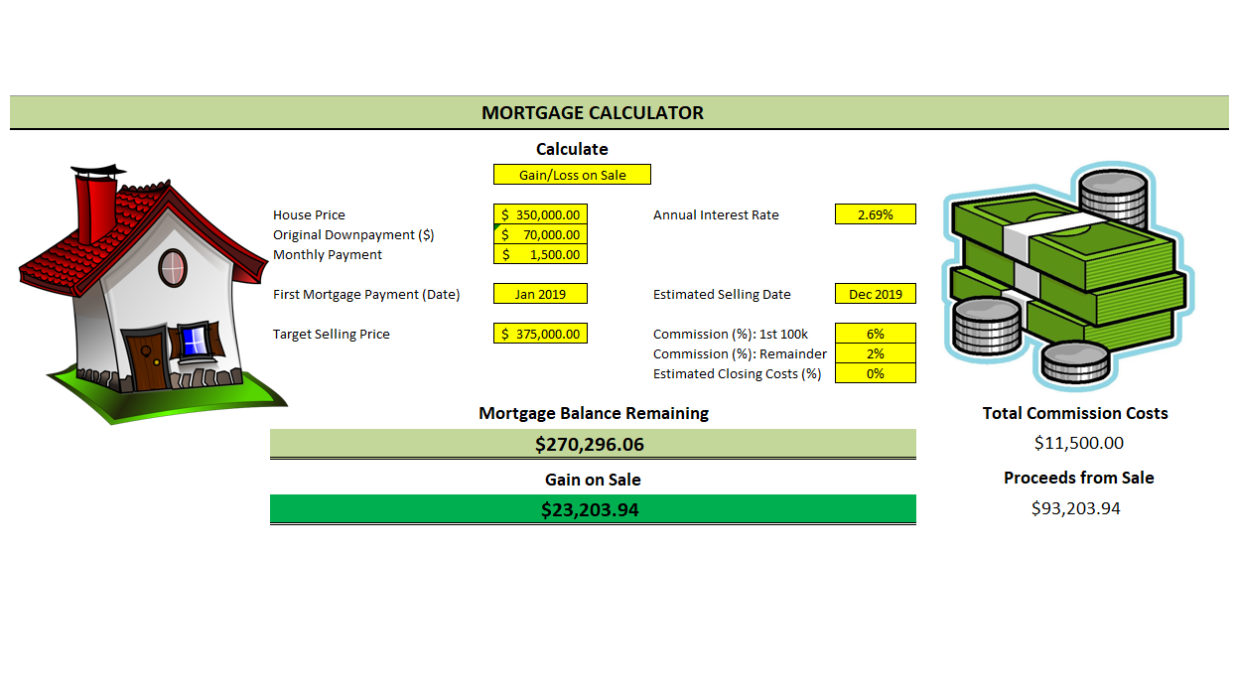

With Chase for Business you’ll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and managing payroll. Choose from business checking, business credit cards, merchant services or visit our business resource center. If you're refinancing your home, enter the current mortgage balance. Ideally, your balance should be less than 80% of your home value to qualify for the best interest rate. If you're applying for a cash-out refinance, enter the additional amount you want to borrow, too.

What's the difference between being prequalified and preapproved?

Mortgage calculator: how much will my mortgage go up? - BBC.com

Mortgage calculator: how much will my mortgage go up?.

Posted: Fri, 05 Jan 2024 08:00:00 GMT [source]

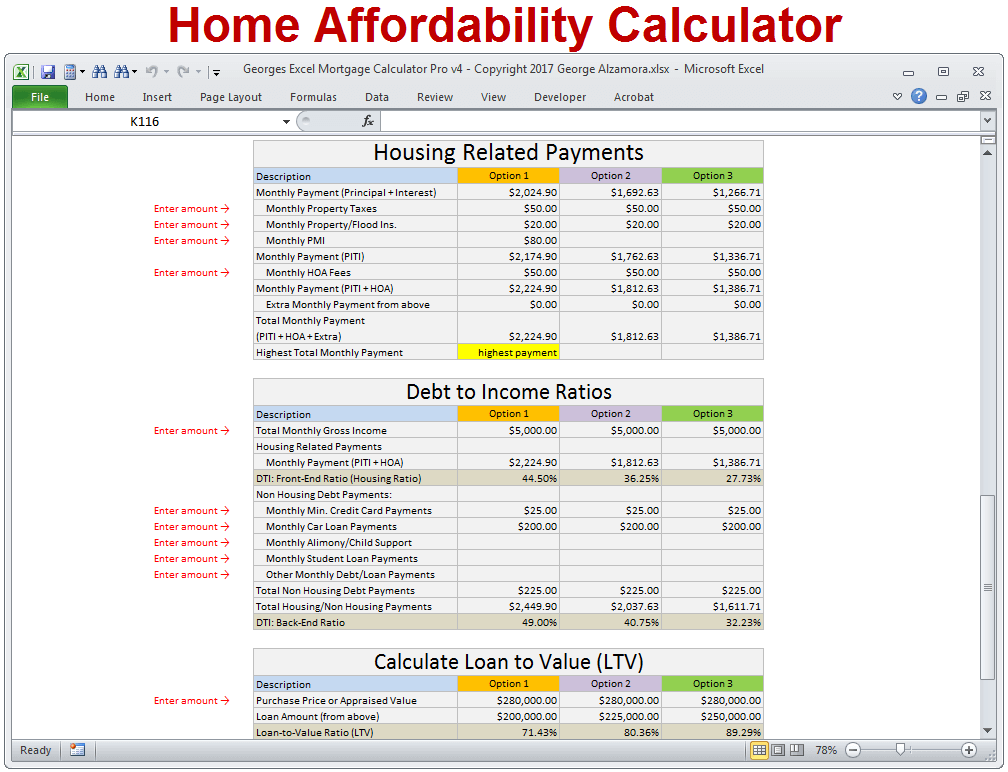

Whether you're thinking about buying your first home or you're ready to refinance your current house, a mortgage calculator can help you understand your monthly payment. It's important to understand how your interest rate, down payment, property location, term and other factors can affect your mortgage payment. Find out how to use a home loan calculator and see how this tool can make calculating your estimated mortgage payment easier. The answer depends on several factors including your interest rate, your down payment amount and how much of your income you’re comfortable putting toward your housing costs each month. Assuming an interest rate of 6.9% and a down payment under 20%, you’d need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage.

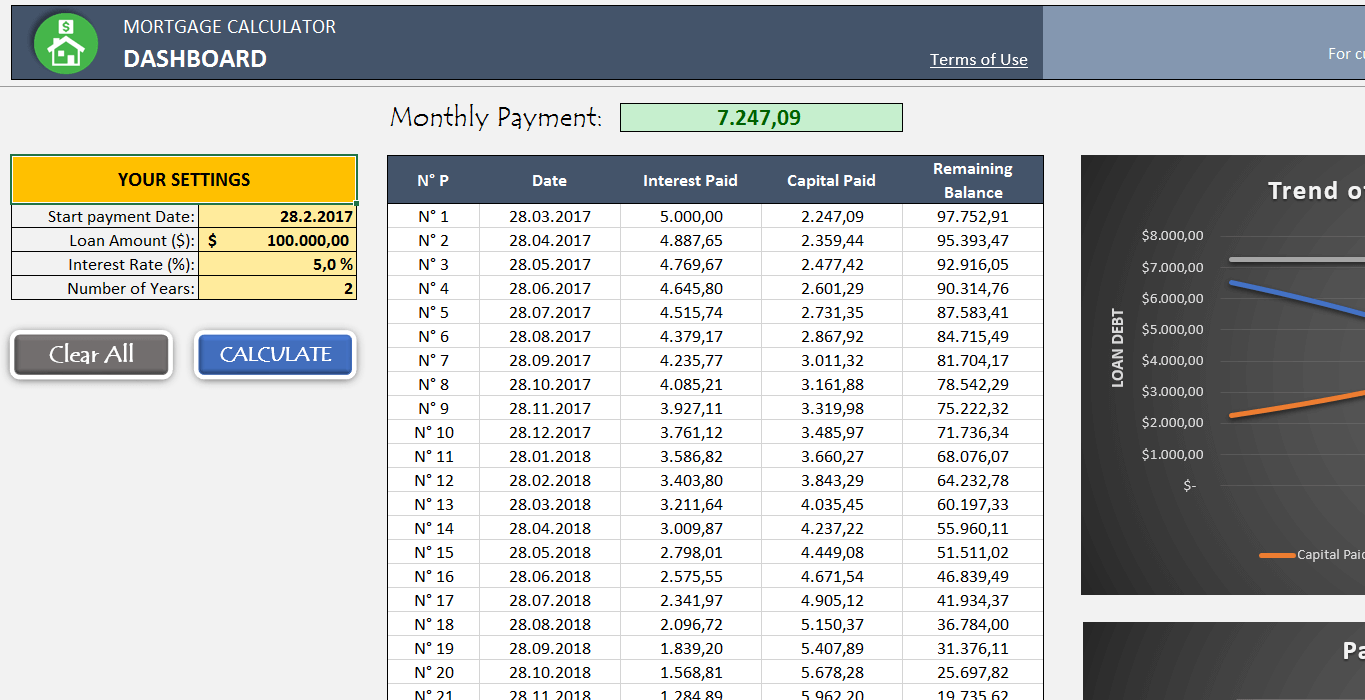

How do you calculate amortization?

Most lenders include one-twelfth of your annual property tax in each monthly mortgage payment. Based on your input, a mortgage calculator provides home loan options and estimates. These calculators are helpful when you want to see estimates for different types of mortgages you might qualify for, or if you want to see how different loan terms would affect your monthly payments. The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. A 20% down payment typically allows you to avoid private mortgage insurance (PMI). The higher your down payment, the less interest you pay over the life of your home loan.

Mortgage Calculator

If the ZIP code includes more than one county, the home loan calculator will prompt you to choose the correct one. The mortgage calculator requires the ZIP code and the county in order to identify the right property tax rates. If you're buying a home, enter the down payment you plan to make. You can either enter the dollar amount or the percentage of the home price. If you enter the amount, the percentage automatically calculates, and vice versa.

A homeowner’s association is an organization in a planned community that maintains and reinforces rules for the properties in its jurisdiction. By purchasing a property in such a community, the homeowner is agreeing to the HOA’s rules and fees. HOAs maintain a significant amount of legal power over property owners regarding the outside conditions of the home.

What Is Amortization?

The calculator auto-populates the current average interest rate. The lower your rate, the more you'll be able to borrow, so shop around and get preapproved with multiple mortgage lenders to see who can offer you the best rate. But remember not to borrow more than what your budget can comfortably handle. Sky high mortgage rates have pushed many hopeful buyers out of the market, slowing homebuying demand and putting downward pressure on home prices. The current supply of homes is also historically low, which will likely push prices up.

Mortgage Preapprovals Vs. Prequalifications: Which Should You Get?

How much of a lump sum payment you can make without penalty depends on the original mortgage principal amount. A down payment is a percentage of the purchase price of a home that the buyer pays upfront. For an instant estimate of what you can afford to pay for a house, you can plug your income, down payment, home location, and other information into a home affordability calculator. The calculator also allows you to easily change certain variables, like where you want to live and what type of loan you get.

Average property tax in California counties

A lot of factors go into that assessment, and the main one is debt-to-income ratio. Under "Down payment," enter the dollar amount of your down payment (if you’re buying) or the amount of equity you have (if refinancing). Or instead of entering a dollar amount, enter the down payment percentage in the window to the right. A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology.

Should I choose a long or short loan term?

Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations.

You can also work on getting a higher credit score and lowering your DTI to get access to lower rates. Rates vary among mortgage lenders, so be sure to get approved with three or four different lenders to be sure you're getting the lowest rate possible. Lenders have a responsibility to make sure they aren't lending more than what their borrowers can afford to pay back.

The amount you pay each month for your mortgage, homeowner’s insurance, and HOA fees. This payment should be no more than 25% of your monthly take-home pay. That leaves plenty of room in your budget to achieve other goals, like saving for retirement or putting money aside for your kid’s college fund.

Get professional advice to make sure you have the proper coverage. Homeowner’s insurance can cover the cost to repair or rebuild due to damage caused by events like fire, windstorms, hail, lightning, theft or vandalism. It can also protect your possessions inside your home like clothes, furniture and electronics.

Loan start date - Select the month, day and year when your mortgage payments will start. If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum.

April was the last month of full program benefits, but households could receive a partial discount in May. Four years ago, Claudia Aleman and her family had only one way to get online — through their cellphones. Pokemon cards have seen a "massive surge", Tracy says, with people paying "thousands and thousands of pounds" for good unopened sets. The predictions come just as the rate of price increases on many food items begins to slow as inflation falls.

No comments:

Post a Comment